car buying scams explained

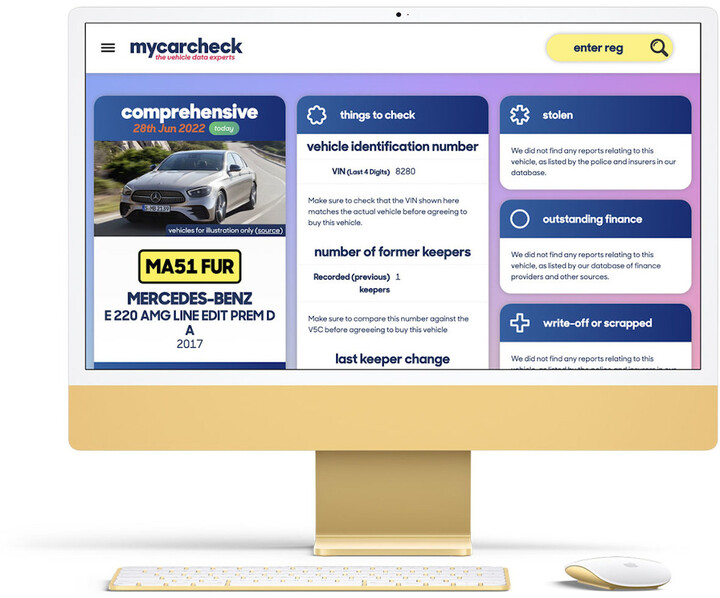

FREE Car History Check

See MOT history, valuations, detailed specs and more… AND upgrade to see if any vehicle has been stolen, has finance or has been written off from just £4.99

As with most industries, some people will be out to make money both illegally and at your expense. Vehicles are worth considerable amounts of money too, making it both appealing to criminals and more important than ever that buyers know what to look out for and how to protect themselves.

It isn’t just the financial impact of buying a car which has a dodgy past: how can you be sure of its safety if you don’t know its history? Do you know the difference between a ringed and a cloned car? And would you know the signs of a clocked car?

Remember, if a car offer seems too good to be true, it probably is. Use My Car Check to confirm the history is as the seller claims, and read our guides on some of the more significant deceits which rogue sellers try to use.

Car Ringing Scam

A car Ringing scam is the process where a stolen car is given the identity of another, written-off vehicle.

Ringing is the process by which a stolen car is given the identity of another, written-off vehicle. Even if purchased in good faith, when discovered, it will be returned to the true owner or insurance company.

A ringed car will have its number plates and Vehicle Identity Number (VIN) replaced. The VIN can be found on a small plate under the bonnet and beneath the carpet on the sill by the driver’s seat. Cars often have them at the base of the windscreen too. Look for signs of tampering and check they match the V5c registration document.

Also look carefully for forged V5c documents (they should have a watermark running through them) and paperwork to support the car’s previous ownership. And use a checking service such as My Car Check to find out if the car in front of you is actually registered as being written-off.

Car Cloning Scam

Cloning is where the identity of one vehicle is used on another identical or similar model. The clone vehicle will carry the same registration plates as the original car to avoid detection.

Cloning is where the identity of one vehicle is used on another identical or similar model. The clone vehicle will carry the same registration plates as the original car to avoid detection. The vehicle might be stolen or merely cloned so its driver avoids speeding or parking fines. The owner of the genuine vehicle will only realise it has been cloned when receiving fines and it will be up to them to prove their innocence.

While there might be some visible signs that new number plates have been attached, it is more important to check them against the Vehicle Identity Number (VIN) on the V5c registration document and compare these with what is actually on the vehicle.

A service such as My Car Check will also provide valuable information about the original car such as specification and mileages which may differ from the cloned vehicle

Cut and Shut Car Scam

Cut and shut is a term used to describe a car where parts of two - or possibly more - vehicles have been put together to create a new car.

Cut and shut is a term used to describe a car where parts of two - or possibly more - vehicles have been put together to create a new car. The real risk here is safety. In the event of an accident, the cut and shut car is unlikely to be as strong as the original car. The donor sections will usually be from crash-damaged vehicles so even the integrity of their ‘good’ bits can be questionable.

At first glance, new paint could appear smart but look for evidence of overspray around lights, windows and door seals. Check the bases of door and window pillars for welding work, and lift carpets and check the underside of the vehicle for further evidence. Remember, a cut and shut vehicle will take the identity of one of its donor vehicles so also check trim, seating and equipment levels are correct for the model of car. And use a history checking service such as My Car Check to reveal whether the car has an undesirable past such as being stolen or written off.

Know your rights when buying a car

Your rights when buying a car differ, depending on where you purchase. Broadly, you will have a lower level of legal protection buying from a private seller or at auction than from a dealer. Dealers are also required to check a vehicle over and confirm the accuracy of its mileage.

Buying a used car from a dealer

When buying from a dealer, you will have the protection of the Consumer Rights Act (from 1st October 2015). This covers three key areas. The car must be:

Of satisfactory quality - which will vary, depending on the age and mileage of a vehicle Fit for purpose - includes any specific requirement you have asked of the dealer As described - from its specification to the vehicle’s condition The Consumer Rights Act sets out some important timelines which determine the buyer’s rights.

If not of satisfactory quality, fit for purpose or as described, a customer is within their rights to reject the vehicle within the first 30 days.

Between 30 days and six months, you could be entitled to a repair, replacement or refund and the law favours the consumer, assuming the fault was present on the vehicle at the time of sale unless the seller can prove otherwise. The dealer also has just one opportunity to fix the issue (unless you agree for them to try more than once). If the dealer does agree to a refund, this may not be for the complete amount; they are entitled to reduce this value by a reasonable sum in line with the vehicle’s use while you have had it.

After six months, it is down to you, the consumer, to prove that any fault was present when you took delivery of the car in order to seek a repair or replacement.

There is also the Consumer Protection from Unfair Trading Regulations (26th May 2008) which applies to vehicle sales and provides a code of conduct for dealers. The seller must not be misleading, either by omitting important facts about the sales process or vehicle, or by providing inaccurate information. And the dealer must not behave aggressively, for example in a threatening or overly persistent manner.

Remember, if buying on-line, the same principles apply as when at a car dealership but in addition, there are Distance Selling Regulations which allow you a ‘cooling off’ period with a right to cancel within seven days.

Of course the Consumer Rights Act is good in theory but it doesn’t protect you from items which fail due to wear and tear through regular use; if the dealer brought to your attention any issues prior to purchase, these won’t be covered either. Also read the small print if buying at auction. ‘Sold as seen’ means exactly that.

Buying a used car privately

While there are many perfectly legitimate private sales, buying privately does carry a higher risk due to there being little legal protection for the buyer. However, there are still some rules which apply.

The car must be roadworthy. Remember, this doesn’t just mean it has a valid MOT certificate (as it might have covered many miles since the MOT test). The car should still be as described. And the seller must have the right to sell that car. So the onus is on the buyer to inspect the vehicle properly and check all the documentation matches. Also, because of the lower level of responsibility for a private seller, be wary of dealers pretending to sell privately to avoid their legal obligations.

Your responsibility

Whatever the law states, resolving issues can be time-consuming and costly. And with 43.2% of vehicles searched using My Car Check in 2016 having at least one warning against them (ranging from minor items like colour changes to having outstanding finance or being written off) it is important you do what you can to protect yourself against a poor purchase.

So wherever you choose to buy a used vehicle, there’s no substitute to using a comprehensive history checking service and having an independent vehicle inspection.

Internet Car Scams Explained

Long gone are the days when car-buying meant discussions with a shady salesman wearing a camel hair coat and trilby hat. Now, whether buying or selling a car, you’ll probably do some part of the process on-line.

On the one hand, the internet makes life easy: searching thousands of cars, researching the model specifications or checking reviews is simple and quick. On the other hand, the internet offers up new ways for criminals to operate. So instead of walking round a car to kick its tyres (not that we’d recommend that of course), we offer some virtual tyre-kicking tips to help you steer clear of scams, whether you are buying or selling on-line.

Selling your car

Buyer doesn’t wish to see the car

Would you really buy a car without seeing it? It’s not unheard of but very rare and could be part of a scam where after taking delivery, a buyer will claim that faults or damage on it were not made clear. They would then seek recompense from you. Always ensure your advert is as complete and accurate as possible. Try to sell to someone who shows up in person and get them to sign a ‘sold as seen’ receipt.

Beware the electronic payment.

A buyer may sound legitimate and might promise a money transfer using a recognised service such as PayPal. But any payment confirmation e-mail could well be fake so check the funds have arrived in your bank account before releasing your car.

And you could be caught-out twice on this if the buyer asks you to ship the car. Not only have you not been paid for the car, you will be out of pocket on its transportation costs too.

The overpayment

This is where the criminal will send a check for too much money or tell you they have overpaid the amount into your account. Perhaps you have seen an e-mail receipt which looks authentic. They will ask for you to refund the difference but in fact their cheque was fake or they didn’t actually pay you. It could be a genuine error but always wait for the funds to have cleared in your account first.

Tips

- Describe your car thoroughly and accurately when creating an advert.

- Question why a buyer wouldn’t wish to see the car in person.

- Cheques and e-mail receipts can be faked: confirm the money is in your account before parting with your car.

- If taking cash, ask to meet at a bank so you can pay it straight in and any counterfeit notes can be detected.

- Search on the internet to check a buyer’s phone number and e-mail. Try calling them back on the number to ensure it is valid.

- Don’t let someone else pay for your car on the behalf of the buyer.

Buying a car

Fake adverts

Fraudulent adverts are sometimes used to encourage you to part with your money. Even if the make and model tie-up, the advert could be made-up or a copy of a genuine advert from elsewhere on the internet. Is the car just a little too cheap? If it feels too good to be true, it probably is.

Ask the seller for as much information as possible and always go and inspect the car. Ensure details like the chassis number, number plate and seller’s address tie up with those on the V5C registration document.

Selling on behalf of someone else

While this does sometimes happen for genuine reasons, it is one to be wary of. Check out the selling company on the internet and see if it really does exist. It is more important than ever to inspect the paperwork and do a history check on the car to ensure it is not stolen.

The car is abroad

An easy con is to claim the car is being offered for sale from abroad. It means you can’t actually go and see it and the vendor will promise it can be shipped only once funds are paid into a holding (Escrow) account. It is likely you will never see the car.

Taking your money

If a seller requests an advanced fee even to see the car, simply look for another vehicle. Any honest seller will understand a potential buyer will wish to look before parting with cash.

Passing on stolen vehicles

Cars might be physically stolen and then offered for sale but there are other reasons it might not be legal for the vendor to sell it.

If it has outstanding finance for example - and is therefore the property of the finance company until it is fully paid-for - it could be repossessed and you could lose all your money and the car. Some fraudsters even try to offer hire cars for sale which don’t even belong to them.

Using a checking service such as My Car Check will show whether there is outstanding finance on a vehicle, whether it has been stolen and other information such as if it has been written-off.

Tips

- Go and see the car in person before paying a deposit or agreeing to purchase it.

- Ensure you see all the paperwork. There must be a V5C registration document but you should expect to see things like receipts from a private seller.

- Always meet at the seller’s home or business premises - otherwise it could be difficult to find them again if things go wrong later.

- Be wary of anyone who only communicates via e-mail.

- Pay safely - using a credit card will give you better protection against shopping fraud.

- Retain details of the advert including description, photos and other information which will give you evidence if things go wrong later.

- Always use a reputable vehicle checking service such as My Car Check.

What is a Cash for Crash Scam?

‘Cash for crash’ scams have gained increasing publicity in the press but what are they and what can you do to help prevent yourself being involved?

What does cash for crash look like?

Cash for crash is where a criminal causes an accident then seeks to gain some type of compensation. The scams may take various forms but they are usually setup to make the innocent driver look like the guilty party.

The car in front might brake very hard for no apparent reason causing you to hit it from behind. It might even be reversed into yours deliberately - and without a witness, there is little to prove it wasn’t your fault.

Another recognised manoeuvre is for a driver to flash headlamps to let you out of a side road then deliberately crashing into your car.

The scammer might carry passengers in the car so each can claim for injuries such as whiplash.

The accident can appear genuine and you might only realise it has been a scam when your insurers share the other driver’s view of events which seem inaccurate or exaggerated.

Who pays?

This isn’t a victimless crime. If you are scammed, you will probably have to pay an insurance excess and potentially lose a no claims discount. And the more insurance companies pay out, the greater the amount everybody’s insurance premiums rise as a result. The impact goes further: organised cash for crash gangs may use the proceeds for illegal activities such as drugs or firearms.

The Insurance Fraud Bureaux (IFB) puts the annual cost of cash for crash fraud at £336 million with one in 10 personal injury claims linked to scams.

Be watchful

You may not be able to prevent all deliberate acts but there are some sensible precautions to minimise the risk of being involved.

- Keeping a safe distance behind the car in front always makes sense: you should always be able to stop if the car in front brakes hard.

- Note any odd or erratic behaviour. If a driver in front is looking behind more than normal they could be lining something up.

- Be wary of seemingly kind drivers signalling to let you out of a junction. And even if a driver is indicating to turn into a side road where you are waiting, don’t pull out unless you are confident the other car is starting to turn.

- All drivers should be watchful but criminals will try to choose an easy victim. Mothers with children in the car and the elderly are favoured targets because they are less likely to cause a fuss.

- If you are involved in a bump, look for signs at the site of the ‘accident’ too. If it was a small impact, is the driver (or passengers) in the other car exaggerating potential injuries? Does the other driver have a note with insurance details already written out? And think about the accident itself: scammers sometimes disable their brake lights so you don’t spot they are stopping in front of you.

Dashcams

The dashboard camera (dashcam) is the latest gadget to help determine blame in any accident, not just those staged for illegal gains. They record video which can be downloaded as evidence in the event of a crash. Basic dashcams start from around £10.

What should you do if you are involved in an accident?

At the scene of any accident, you should try to remain calm and don’t admit any liability.

Call the police if you believe the accident has been staged. If anyone is showing signs of injury - whether real or not - it is worth dialling 999. If they are hurt, they should receive medical attention. If they are not genuinely injured, their behaviour might change and give away that they were intending to claim fraudulently.

Make notes about what happened leading up to the crash and at the point of impact. Take details of the position of the vehicles, the people involved, and anything said.

Take photographs at the scene, especially any damage but do this discretely if possible.

If you do have any suspicions that you have been involved in a cash for crash scam, make your insurer aware. They should be happy to investigate.

You should also contact the Insurance Fraud Bureaux, at www.insurancefraudbureau.org or by calling Cheat Line on 0800 422 0421.