insurance fraud: why honesty remains the best policy

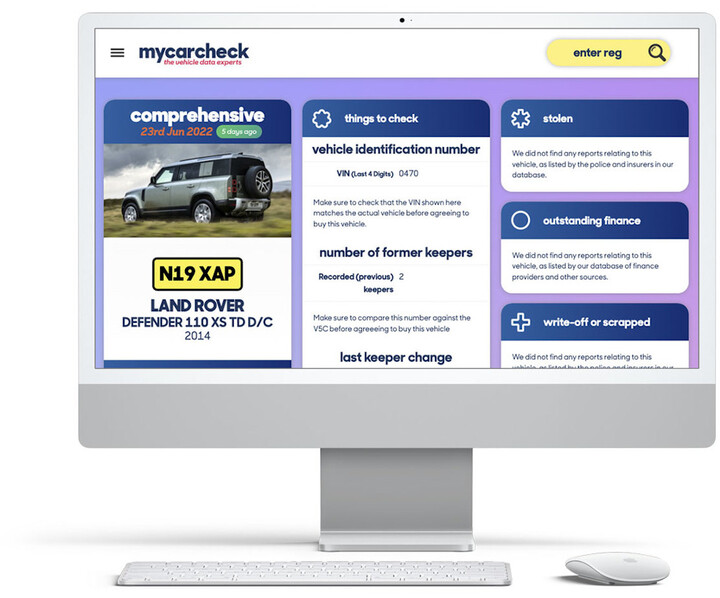

FREE Car History Check

See MOT history, valuations, detailed specs and more… AND upgrade to see if any vehicle has been stolen, has finance or has been written off from just £4.99

Car insurance is a legal requirement in the UK, which means it is one of the largest sectors for fraud. Whether this is done on purpose or accidentally, it is a huge deal for insurance companies and can lead to some serious penalties, including prison.

However, the ins and outs of insurance can be confusing, and this can lead many drivers to make mistakes when applying. With the issue being one that is escalating all the time, it is imperative that people applying for insurance are truthful about everything.

So, what’s the deal with insurance fraud, what are the penalties, and how can you avoid invalidating your cover?

What is insurance fraud?

Insurance fraud is an offence whereby the person applying is withholding information from the insurer. This could be anything, regardless of its perceived insignificance. For example, giving the wrong name, address, or occupation is considered fraud.

There are a few different types of fraud to be aware of. These are:

-

Change of circumstances: When calculating how much to charge for insurance, brokers need to know a number of things. These may seem inconsequential but they are imperative for the broker to know in order to work out the best policy and price. Therefore, if you do not declare a change in circumstance (e.g., new address, occupation, commuter status), you will be committing fraud.

-

Fronting This is when a person adds someone as their secondary or named driver when they are actually going to be the main driver. A common example is a parent adding their child to their own policy rather than setting up their own. In this instance, the younger driver’s insurance is likely to be cheaper, but this is against the law.

-

Making modifications If you modify your car in any way that changes it from the factory standard, but you do not declare it to your insurer, you are committing fraud. You may want to increase security, or add something aesthetic to your vehicle; but if these are not included as part of your insurance application, or you later decide to make changes without informing your insurer, you will be in line for a substantial penalty as well as invalidating your policy.

What happens if you get caught for insurance fraud?

Of course, the worst penalty for committing car insurance fraud will be criminal prosecution, depending on the severity of the crime. The main issue many will face, however, is the invalidation of their policy. This means they are not covered and, if they choose to continue to drive without insurance, they’re committing a whole other crime entirely.

Drivers who have committed fraud in the past will also find it extremely hard, if not impossible, to find insurance in the future. At the very least you will be left without cover, and at the most you will have a criminal record and be blacklisted by insurers going forward.

Where do I report insurance fraud?

If you suspect someone of committing insurance fraud, you can report them to the Insurance Fraud Bureau (IFB). Although you might not like the idea of reporting someone, car insurance fraud is not a victimless crime. In fact, the costs associated with fraud push the price of insurance up for other customers, leaving you unnecessarily out of pocket.

There are a number of organisations out there that work tirelessly to identify and bring a stop to insurance fraud, such as the IFB mentioned above and the Insurance Fraud Enforcement Department, which is a dedicated police unit set up in 2012. It is funded by the insurance industry and has been responsible for over 400 convictions.

If a person is reported and prosecuted, they are likely to be added to the Insurance Fraud Register, which is a database that logs those that have been caught. If your name is on that register, it will become infinitely more difficult to find insurance in the future.

Can you accidentally commit insurance fraud?

It is possible to commit car insurance fraud accidentally. Withholding information is actually one of the most common types of fraud, and some drivers may not even realise they are doing it. As mentioned above, changes in circumstance are often thought of as insignificant, however it is precisely this type of fraud that happens most frequently.

Another thing people try to withhold are penalty points on a license. In fact, research from the RAC, conducted in 2017, shows that 23% of drivers failed to tell their insurer that they had gotten penalty points on their license. However, it could be argued that this is not in any way an accident, as most people are aware that having penalty points significantly affects the price of insurance premiums.

Whatever the information, it is always best to err on the side of caution and be honest about everything. It is never worth the risk, particularly if you would be left without cover and unable to drive at all. Honesty is always the best policy with insurance.

How do I fight a false insurance claim in the UK?

Unfortunately, there are people out there who operate ‘crash for cash’ insurance scams whereby they will get into an accident on purpose, purport it to be the other person’s fault, therefore being able to make a claim on their insurance even though they are the person at fault.

If you think you might have been involved in such a scam, make sure you take all the information you can from the person who crashed into you and get the police involved as a matter of urgency. Similarly, you should contact your insurer to let them know about your suspicions. Then, call the Insurance Fraud Bureau’s Cheatline (0800 422 0421), and they will help you as much as they can.

Avoid buying a car that’s been used in a scam, find out the history of your vehicle with a check from mycarcheck; then you can buy with confidence and peace of mind.